A VAT Calculator is a simple yet powerful tool that helps individuals and businesses quickly calculate Value Added Tax (VAT) on goods or services. Whether you’re a shopper trying to figure out how much tax you’ll pay, or a business owner needing to add or subtract VAT from prices, this calculator makes it easy. By entering the price and the VAT rate, you can instantly see the tax amount and the total cost. It saves time, reduces errors, and ensures you stay compliant with tax regulations.

VAT Calculator

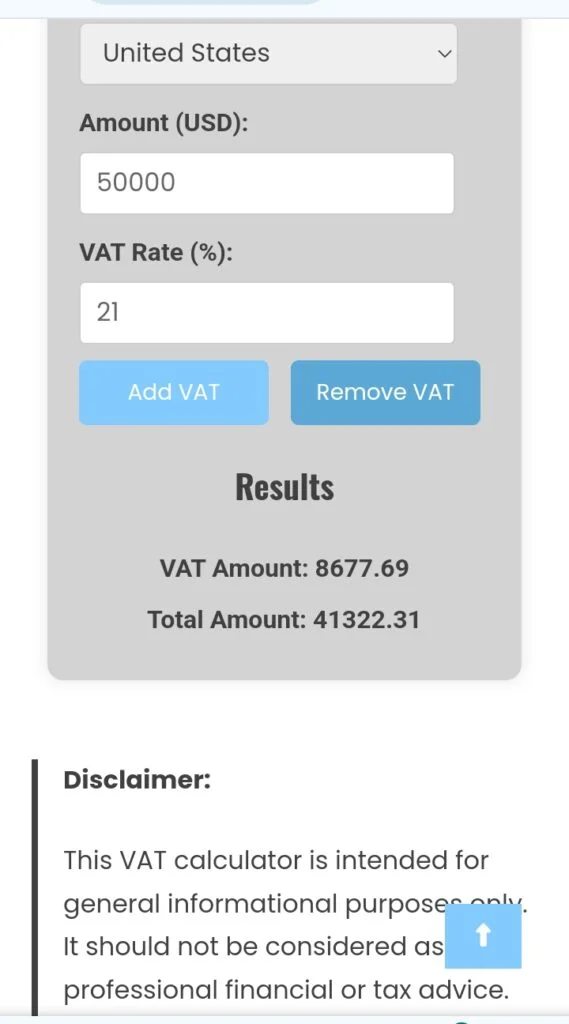

Results

VAT Amount: 0.00

Total Amount: 0.00

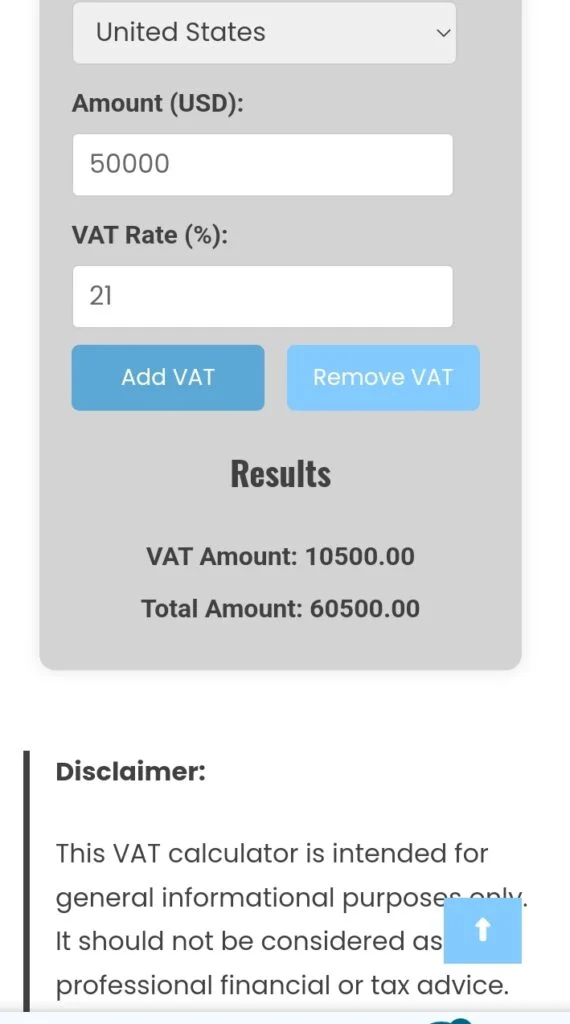

Disclaimer:

This VAT calculator is intended for general informational purposes only. It should not be considered as professional financial or tax advice. The results may vary depending on specific circumstances, and it’s always recommended to confirm and make the sure the rates are accurate. Consult with a tax professional or financial advisor to ensure accuracy and compliance with local tax laws.

How to Use the VAT Calculator

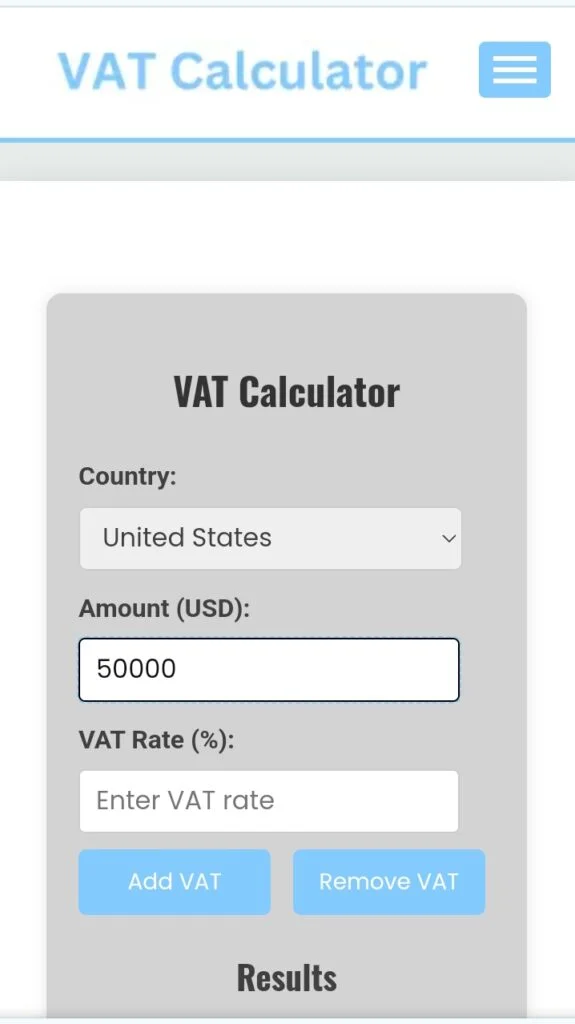

The VAT Calculator is designed to help you easily calculate Value Added Tax (VAT) for various countries. Follow these steps to use the calculator:

Select a Country:

- Use the dropdown menu labeled “Country” to select your country. The VAT rate will automatically update based on the country you choose.

Enter the Amount:

- In the “Amount” field, input the amount you want to calculate VAT for. The currency symbol will change according to the country selected.

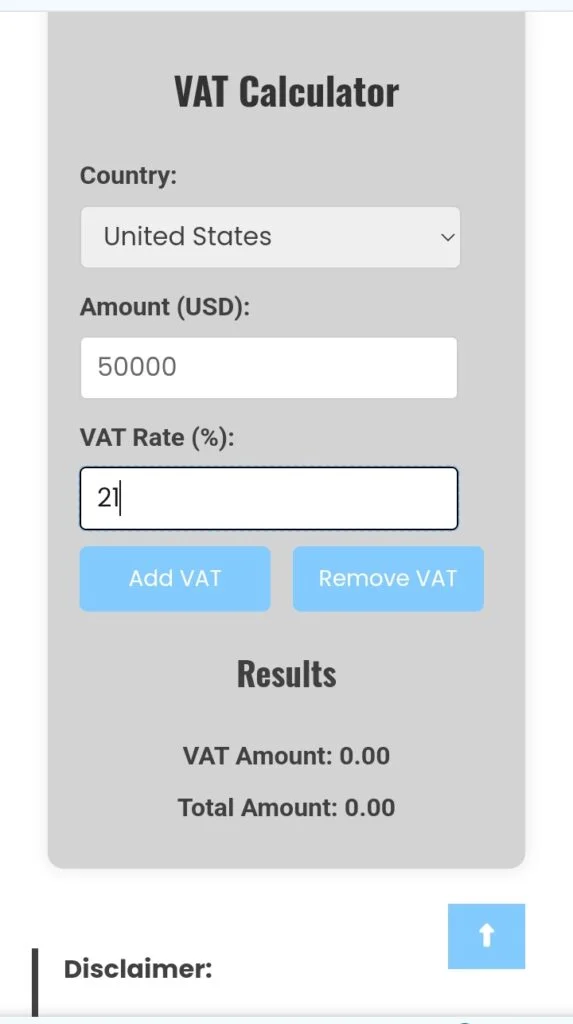

Check or Adjust the VAT Rate:

- The VAT rate will auto-fill based on the selected country. If you need to adjust the VAT rate, you can do so in the “VAT Rate” field.

Calculate VAT:

- Click the “Add VAT” button to calculate the total amount including VAT.

- Click the “Remove VAT” button to calculate the base amount before VAT was added.

View Results:

- The results will display below the buttons:

- VAT Amount: The amount of VAT added or removed.

- Total Amount: The total amount including VAT if you added it, or the amount before VAT if you removed it.

This simple tool makes it easy to quickly find out how much VAT will be added to or deducted from your transaction.

VAT: Overview

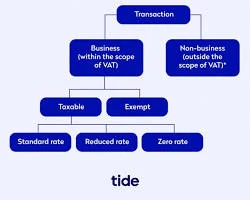

Vat can be defined as a consumption tax that is on goods and services, which is levied at each stage of the consumer supply chain where value is added. VAT can also be called goods and services tax (GST) and general consumption tax (GCT).

What is VAT used for?

Value added tax is mainly employed by governments to increase country’s source of revenue to fund government programs. The followings are various why governmens collect VAT:

- Vat is used to reduce tax evasion in the country. It is used to create checks and balances. This is because VAT is collected at different stages of the consumer supply chain.

- Value added tax is a good source of generating money for funding government’s programs such as building of healthcare and education infrastructures, public services payment, construction of roads, and so on.

- It is also used to tax consumer spending. Value added tax helps ensure that individuals pay tax on goods and services at the final stage of consumption. And this makes VAT fair and efficient way to collect tax from consumer.

History of Value-Added Taxes

The concept of Value-Added Tax (VAT) was first proposed by German industrialist Wilhelm von Siemens in 1918. Siemens aimed to replace the existing turnover tax in Germany with VAT to reduce inefficiencies in the tax system. However, it wasn’t until 1968 that Germany officially replaced the turnover tax with VAT. The first modern implementation of VAT occurred in 1954 when Maurice Lauré, joint director of the French tax authority, introduced it in France’s Ivory Coast colony. The success of the system led France to adopt VAT domestically in 1958, initially targeting large businesses before extending it to all sectors. Today, VAT remains a significant source of revenue for France, accounting for nearly half of its state income.

With the creation of the European Economic Community (EEC) in 1957, harmonizing tax systems became a priority to eliminate competition distortions among member states. In 1960, the European Commission established the Fiscal and Financial Committee, led by Professor Fritz Neumark, to address disparities in indirect tax systems across Europe. The committee aimed to find a unified approach to taxation that would benefit trade and economic integration among EEC member countries.

In 1962, the Neumark Report recommended adopting France’s VAT system, deeming it the most efficient and straightforward model for indirect taxation. As a result, in 1967, the EEC issued two VAT directives, laying the foundation for VAT’s introduction across its member states. Soon after, countries such as Belgium, Italy, Luxembourg, the Netherlands, and West Germany implemented VAT, following the blueprint provided by the EEC, marking the beginning of widespread VAT adoption in Europe.

For more details about the history of VAT, check out here and here.

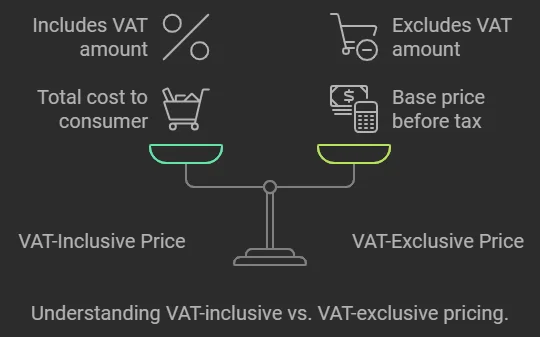

VAT inclusive and VAT exclusive formula

The VAT inclusive and VAT exclusive formulas are methods to calculate the amount of Value-Added Tax (VAT) in a price and to determine either the price before VAT or the price including VAT.

VAT Inclusive Formula

This formula is used when the total price already includes VAT, and you want to find the VAT amount or the original price before VAT was added. The formula for VAT amount is:

- VAT Amount = Total Price × (VAT Rate / (1 + VAT Rate))

- For the price before VAT, subtract the VAT amount from the total price.

VAT Exclusive Formula

This formula is used when the price does not include VAT, and you want to calculate the total price after VAT is added. The formula to find the VAT amount is:

- VAT Amount = Price × VAT Rate

- The total price including VAT is the original price plus the VAT amount.

These formulas help businesses accurately apply VAT to their pricing or determine VAT costs within total prices, ensuring compliance with tax requirements.

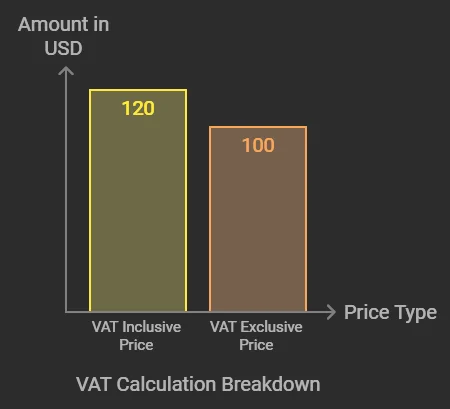

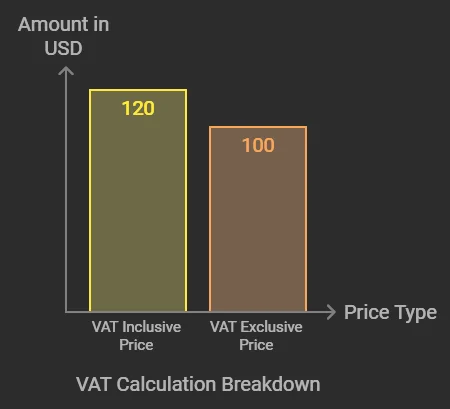

VAT Inclusive Calculation example

Calculating VAT inclusively is about determining how much VAT is already included in the price of a product or service. Here’s a step-by-step example to understand how it works:

Example:

Imagine you bought a product for $120, and this price includes VAT at a rate of 20%. Here’s how you would break it down:

- Identify the VAT rate: In this case, it’s 20%.

- Formula for VAT Inclusive Calculation:Original Price=Total Price÷ (1+VAT Rate)

- Calculate the Original Price (price without VAT): Original Price=1201+0.20=1201.20=100

- Calculate the VAT Amount: Subtract the Original Price from the Total Price:VAT Amount=120−100=20

VAT Exclusive Calculation Example

VAT-exclusive calculation involves calculating the VAT amount separately and adding it to the base price of a product or service. Here’s how it works in words.

Example:

Imagine you’re buying a product listed at $100, and the VAT rate is 20%. Since this price doesn’t yet include VAT, we’ll need to calculate the VAT amount and add it to get the total cost.

- Identify the Base Price: The price before VAT, which is $100 in this case.

- Calculate the VAT Amount: To find the VAT amount, you take 20% of the base price.

- In words, multiply the base price ($100) by the VAT rate (20% or 0.20). This gives you $20.

- Add the VAT Amount to the Base Price: Now, you add the $20 VAT amount to the $100 base price.

- Total Price: The final amount is $120, which now includes VAT.

Advantages and Disadvantages of VATs

Value-Added Taxes vs. Sales Taxes

Value-Added Tax (VAT) Refunds

World Countries With Their VAT Rates

Note that vat rate can be updated by regulations from time to time. Despite we try to update this page with up-to-date information, it is important to always confirm with each country official tax information website.

| Country | Standard VAT Rate | Reduced VAT Rate(s) |

|---|---|---|

| Afghanistan | 10% | None |

| Albania | 20% | 6% (accommodation services) |

| Algeria | 19% | 9% (essentials) |

| Andorra | 4.5% | None |

| Angola | 14% | 5% (essentials) |

| Argentina | 21% | 10.5% (essentials) |

| Armenia | 20% | None |

| Australia | 10% | None |

| Austria | 20% | 10%, 13% (food, books, hotels) |

| Azerbaijan | 18% | 0%, 8% (food, services) |

| Bahrain | 10% | None |

| Bangladesh | 15% | 5%, 10% (reduced on specific services) |

| Barbados | 17.5% | None |

| Belarus | 20% | 10% (essentials, children’s goods) |

| Belgium | 21% | 6%, 12% (essentials, restaurants) |

| Belize | 12.5% | None |

| Benin | 18% | None |

| Bhutan | 5% | None |

| Bolivia | 13% | None |

| Bosnia and Herzegovina | 17% | None |

| Botswana | 14% | None |

| Brazil | 17%-20% (state-dependent) | 7%-12% (essentials, regional differences) |

| Brunei | No VAT | N/A |

| Bulgaria | 20% | 9% (tourism, hotel services) |

| Burkina Faso | 18% | None |

| Burundi | 18% | None |

| Cambodia | 10% | None |

| Cameroon | 19.25% | None |

| Canada | 5% (GST) | None (provinces have additional sales taxes) |

| Cape Verde | 15% | None |

| Central African Republic | 19% | None |

| Chad | 18% | None |

| Chile | 19% | None |

| China | 13% | 9% (food, transport) |

| Colombia | 19% | 5% (essentials, agriculture, hotels) |

| Comoros | 10% | None |

| Congo (Brazzaville) | 18% | None |

| Congo (Kinshasa) | 16% | None |

| Costa Rica | 13% | 4%, 2%, 1% (basic necessities) |

| Croatia | 25% | 5%, 13% (essentials, tourism) |

| Cuba | 20% | None |

| Cyprus | 19% | 5%, 9% (food, medicine, tourism) |

| Czech Republic | 21% | 10%, 15% (food, healthcare) |

| Denmark | 25% | None |

| Djibouti | 10% | None |

| Dominica | 15% | None |

| Dominican Republic | 18% | 16% (some items) |

| Ecuador | 12% | None |

| Egypt | 14% | 5% (essentials, medicine) |

| El Salvador | 13% | None |

| Estonia | 20% | 9% (books, medicine) |

| Eswatini | 15% | None |

| Ethiopia | 15% | None |

| Fiji | 9% | None |

| Finland | 24% | 10%, 14% (essentials, tourism) |

| France | 20% | 5.5%, 10% (essentials, housing, restaurants) |

| Gabon | 18% | None |

| Gambia | 15% | None |

| Georgia | 18% | None |

| Germany | 19% | 7% (food, books, healthcare) |

| Ghana | 15% | None |

| Greece | 24% | 6%, 13% (essentials, hotels) |

| Grenada | 15% | None |

| Guatemala | 12% | None |

| Guinea | 18% | None |

| Guyana | 14% | None |

| Haiti | 10% | None |

| Honduras | 15% | None |

| Hong Kong | No VAT | N/A |

| Hungary | 27% | 5%, 18% (food, healthcare, services) |

| Iceland | 24% | 11% (food, tourism) |

| India | 18% | 0%, 5%, 12%, 28% (goods and services vary) |

| Indonesia | 11% | None |

| Iran | 9% | None |

| Iraq | 15% | None |

| Ireland | 23% | 9%, 13.5% (hospitality, tourism) |

| Israel | 17% | None |

| Italy | 22% | 5%, 10% (essentials, tourism) |

| Jamaica | 15% | 10% (tourism) |

| Japan | 10% | 8% (food, non-alcoholic beverages) |

| Jordan | 16% | 4%, 10% (essentials, medicine) |

| Kazakhstan | 12% | None |

| Kenya | 16% | 0% (exports, essentials) |

| Kuwait | No VAT | N/A |

| Kyrgyzstan | 12% | None |

| Laos | 10% | None |

| Latvia | 21% | 5%, 12% (essentials) |

| Lebanon | 11% | None |

| Lesotho | 15% | None |

| Liberia | 10% | None |

| Libya | 5% | None |

| Lithuania | 21% | 5%, 9% (essentials, services) |

| Luxembourg | 17% | 3%, 8% (essentials, tourism) |

| Madagascar | 20% | None |

| Malawi | 16.5% | None |

| Malaysia | No VAT (SST 10%) | N/A |

| Maldives | 6% | None |

| Mali | 18% | None |

| Malta | 18% | 5%, 7% (essentials, tourism) |

| Mauritania | 16% | None |

| Mauritius | 15% | None |

| Mexico | 16% |

VAT Rates for Different Countries: Table 2

| Country | Standard VAT Rate | Reduced VAT Rate(s) |

|---|---|---|

| Mexico | 16% | 8% (border regions) |

| Moldova | 20% | 8% (food), 12% (certain goods and services) |

| Monaco | 20% | 5.5%, 10% (similar to France) |

| Mongolia | 10% | None |

| Montenegro | 21% | 7%, 0% (basic necessities, medicines) |

| Morocco | 20% | 7%, 10%, 14% (food, housing, etc.) |

| Mozambique | 17% | None |

| Myanmar | 5% | None |

| Namibia | 15% | None |

| Nepal | 13% | None |

| Netherlands | 21% | 9% (food, medicines, books) |

| New Zealand | 15% | None |

| Nicaragua | 15% | None |

| Niger | 19% | None |

| Nigeria | 7.5% | None |

| North Macedonia | 18% | 5%, 10% (food, medicine, hotels) |

| Norway | 25% | 15% (food), 12% (hotel accommodation) |

| Oman | 5% | None |

| Pakistan | 17% | 0%, 5% (essential food, healthcare) |

| Panama | 7% | 10% (hotel and tourism), 15% (alcohol) |

| Papua New Guinea | 10% | None |

| Paraguay | 10% | 5% (basic food items, pharmaceuticals) |

| Peru | 18% | None |

| Philippines | 12% | None |

| Poland | 23% | 5%, 8% (essentials, healthcare) |

| Portugal | 23% | 6%, 13% (essentials, hospitality) |

| Qatar | No VAT | N/A |

| Romania | 19% | 5%, 9% (food, books, pharmaceuticals) |

| Russia | 20% | 10% (food, medicine, children’s goods) |

| Rwanda | 18% | None |

| Saint Kitts and Nevis | 17% | None |

| Saint Lucia | 12.5% | None |

| Saint Vincent and the Grenadines | 16% | None |

| Samoa | 15% | None |

| San Marino | No VAT | N/A |

| Saudi Arabia | 15% | None |

| Senegal | 18% | None |

| Serbia | 20% | 10% (essentials, hospitality) |

| Seychelles | 15% | None |

| Sierra Leone | 15% | None |

| Singapore | 8% (2024 rate) | None |

| Slovakia | 20% | 10% (food, books, medicine) |

| Slovenia | 22% | 9.5% (food, healthcare, accommodation) |

| Solomon Islands | 10% | None |

| Somalia | 10% | None |

| South Africa | 15% | 0% (basic food items, exports) |

| South Korea | 10% | None |

| South Sudan | 18% | None |

| Spain | 21% | 4%, 10% (essentials, hospitality) |

| Sri Lanka | 15% | None |

| Sudan | 17% | None |

| Suriname | 10% | None |

| Sweden | 25% | 6%, 12% (food, culture, hospitality) |

| Switzerland | 7.7% | 2.5% (food, books, medicine), 3.7% (hotels) |

| Syria | 10% | None |

| Taiwan | 5% | None |

| Tajikistan | 18% | None |

| Tanzania | 18% | None |

| Thailand | 7% | None |

| Togo | 18% | None |

| Tonga | 15% | None |

| Trinidad and Tobago | 12.5% | None |

| Tunisia | 19% | 7%, 13% (essentials, tourism) |

| Turkey | 18% | 1%, 8% (essentials, food, healthcare) |

| Turkmenistan | 15% | None |

| Uganda | 18% | None |

| Ukraine | 20% | 7% (medicine, books) |

| United Arab Emirates | 5% | None |

| United Kingdom | 20% | 5% (energy, healthcare) |

| United States | No VAT (sales tax) | N/A (varies by state) |

| Uruguay | 22% | 10% (basic necessities, medicines) |

| Uzbekistan | 15% | None |

| Vanuatu | 12.5% | None |

| Venezuela | 16% | None |

| Vietnam | 10% | 5% (essentials, education) |

| Yemen | 5% | None |

| Zambia | 16% | None |

| Zimbabwe | 14.5% | None |

FAQs: What is the VAT on 5000?

- To determine the VAT on $5,000, you’ll need to know the VAT rate. If the VAT rate is 20%, the VAT on $5,000 would be $1,000.

- Formula: VAT = (VAT rate) x (Net amount).

- Example: VAT = 20% x $5,000 = $1,000.

How is VAT charged?

- VAT is charged on the sale of goods and services by businesses that are VAT-registered. It is included in the sale price, and the final consumer pays it. The business then remits the VAT collected to the tax authorities.

How to calculate VAT from net?

- To calculate VAT from a net amount (the price before VAT), use this formula:

- Formula: VAT = (Net amount) x (VAT rate).

- Example: If the net amount is $100 and the VAT rate is 20%, the VAT would be $20.

How to calculate VAT in receipt?

- To calculate VAT included in a receipt (where the total amount includes VAT), use the formula:

- Formula: VAT = (Total amount) x (VAT rate / (1 + VAT rate)).

- Example: If the total amount is $120 and the VAT rate is 20%, the VAT is $120 x 20/120 = $20.

Learn more about Calculating vat here.

How much VAT on 350?

- To calculate the VAT on $350, use the formula:

- Formula: VAT = (VAT rate) x (Net amount).

- Example: If the VAT rate is 20%, the VAT on $350 would be $70 (20% x $350).

How to include VAT in price?

- To include VAT in the price, add the VAT amount to the net price:

- Formula: Gross price = Net price + VAT.

- Example: If the net price is $100 and the VAT is $20, the gross price including VAT is $120.

Which method is used to calculate VAT?

- The common method used to calculate VAT is the invoice-based method. Businesses charge VAT on their sales invoices and can deduct the VAT paid on their purchases (input VAT) from the VAT they owe to the tax authorities.

Do you pay VAT on all sales?

- VAT is typically paid on most sales of goods and services, but there are exceptions. Some items may be zero-rated or exempt from VAT, depending on the jurisdiction.

For more details, check out this study.

Who pays for the VAT?

- The end consumer ultimately pays for the VAT, as it is included in the price of goods and services. Businesses collect the VAT on behalf of the government and remit it.

Check here for details about the causes and consequences of vat.

Who doesn’t pay VAT?

- Certain individuals or entities, like some non-profit organizations or small businesses under a certain threshold, might not pay VAT. Additionally, items classified as zero-rated or exempt are not subject to VAT.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

Distribution of Vat Rates in Different Countries

| Country | Standard VAT Rate | Reduced VAT Rate | VAT Authority Website |

|---|---|---|---|

| United Kingdom | 20% | 5% | UK VAT |

| Ireland | 23% | 13.5%, 9%, 4.8% | Revenue Ireland |

| Afghanistan | 10% | – | – |

| Albania | 20% | 6% | – |

| Algeria | 19% | 9% | – |

| Andorra | 4.5% | 9.5% (higher), 1% (reduced) | Andorra VAT |

| Angola | 14% | 7%, 5% | Angola VAT |

| Anguilla | 13% | – | Anguilla GST |

| Argentina | 21% | 27% (higher), 10.5%, 3% | – |

| Australia | 10% | – | ATO GST |

| Austria | 20% | 13%, 10% | Austria VAT |

| Azerbaijan | 18% | – | Azerbaijan VAT |

| Bahamas | 10% | – | Bahamas VAT |

| Bahrain | 10% | – | Bahrain VAT |

| Bangladesh | 15% | 10%, 7.5%, 5%, 4.5%, 2%, 1.5% | Bangladesh VAT |

| Barbados | 17.5% | 22% (higher), 10% | Barbados VAT |

| Belarus | 20% | 26% (higher), 10% | Belarus VAT |

| Belgium | 21% | 12%, 6% | Belgium VAT |

| Benin | 18% | – | Benin VAT |

| Bolivia | 13% | – | Bolivia VAT |

| Bosnia & Herzegovina | 17% | – | Bosnia VAT |

| Botswana | 14% | – | Botswana VAT |

| Brazil | 18% | 12%, 7%, 2%-5%, 1.6%-7.6%, 3% | Brazil VAT |

Reference

- Savitri, Dian & Subagja, Roni & Rosadi, Dadi & Raharjo, Adi & Sudrajat, Adjat. (2023). Application of Value Added Tax Calculation on Sales: Case Study of PT. Tiga Nova Sentosa. Informatics Management, Engineering and Information System Journal. 1. 7-15. 10.56447/imeisj.v1i1.225.

- Estimating the Base of the Value-Added Tax (VAT) in Developing Countries

- Analysis of Value Added Tax Payment and Reporting Calculation for Self-Building Activities. Retrieved from here.

- The value added tax: Its causes and consequences

- Alavuotunki, K., Haapanen, M., & Pirttilä, J. (2018). The Effects of the Value-Added Tax on Revenue and Inequality. The Journal of Development Studies, 55(4), 490–508. Retrieved from here

- Omodero, C. O., & Eriabie, S. (2022). Valued added taxation and industrial sector productivity: a granger causality approach. Cogent Business & Management, 9(1). Retrieved from here

- Bird, Richard. (2005). Value-Added Taxes in Developing and Transitional Countries: Lessons and Questions. Retrieved from here