An Ireland VAT Calculator is a simple Vat calculator designed to help individuals and businesses calculate Value Added Tax (VAT) on goods and services in Ireland. The standard VAT rate in Ireland is 23%, but reduced rates also apply to certain products and services.

With this calculator, you can easily add VAT to net prices or work out the VAT portion from a gross amount. Whether you’re a business issuing invoices or a customer checking VAT costs, the Ireland VAT Calculator ensures fast and accurate tax calculations, helping you stay compliant with Irish tax laws.

Ireland VAT Calculator

Disclaimer:

This Ireland VAT Calculator is a tool designed for informational purposes only and should not be considered as financial or tax advice. The rates and calculations provided by this tool are based on general VAT rules applicable in Ireland, but they may not account for all factors, exemptions, or special rates that apply to specific goods, services, or business circumstances.

Please consult with a certified tax professional or refer to the latest guidelines from the Irish Revenue Commissioners for precise, up-to-date information tailored to your specific situation. While efforts are made to ensure accuracy, we do not guarantee that all information provided by this calculator is accurate, complete, or current. Use of this tool is at your own discretion, and we are not liable for any actions taken based on the results generated.

What is the VAT Rate in Ireland?

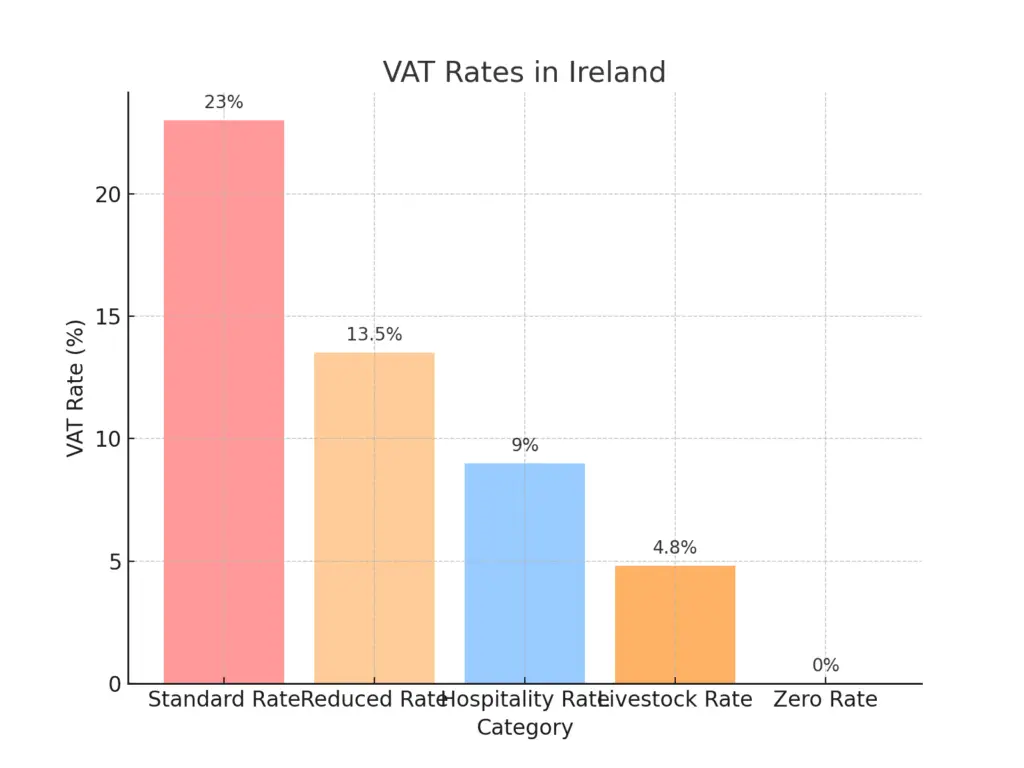

Ireland has a standard VAT (Value Added Tax) rate of 23%. This rate applies to most goods and services. However, Ireland also has several reduced VAT rates to support specific sectors and essential goods.

These reduced rates are: 13.5%: Applied to services like electricity, gas, fuel, construction, and certain tourist services. 9%: Temporary reduced rate primarily for the hospitality sector, including restaurant meals, hotels, and some printed materials like newspapers. 4.8%: Applies to livestock, such as cattle and horses. 0% (Zero Rate): Essential items such as most food items, children’s clothing and shoes, books, and certain medical products.

Ireland’s VAT system is structured to support specific industries and help lower the cost of living by applying reduced or zero rates on everyday essentials.

VAT Exceptions in Ireland

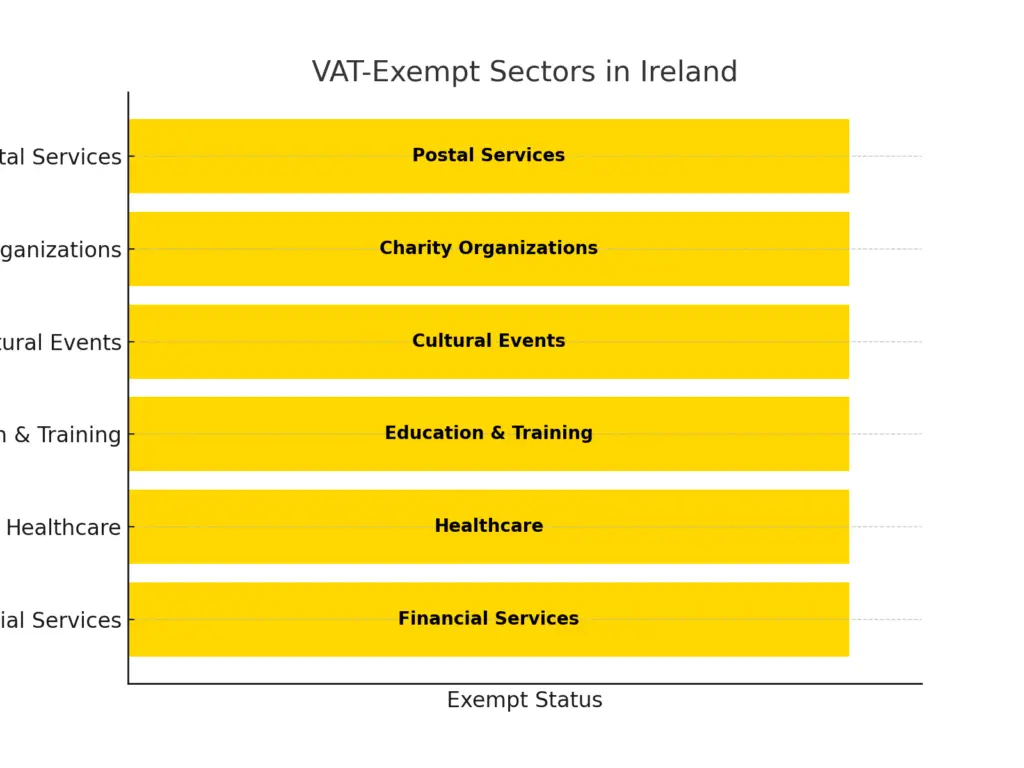

Certain goods and services are exempt from VAT in Ireland, meaning that VAT is not applied to them, and businesses providing these services cannot reclaim VAT on their purchases.

Key VAT exceptions include: Financial and Banking Services: Services like loans, mortgages, insurance, and other standard financial services are exempt from VAT. Healthcare Services: Most medical services provided by certified medical professionals (e.g., doctors, dentists) are VAT-exempt, aiming to keep healthcare affordable.

Education and Training: Educational services, including schools, colleges, and professional training programs, are generally exempt from VAT. Cultural and Artistic Events: Some cultural events, such as performances by artists or theatre companies, can be VAT-exempt to support the arts sector.

Charity and Non-Profit Organizations: Charitable activities, particularly fundraising, are often VAT-exempt, benefiting registered non-profit organizations. Postal Services: Standard postal services are exempt from VAT to ensure accessibility and affordability.

Ireland’s VAT structure is designed to balance tax revenue with economic support, reducing the burden on vital goods and services like food, healthcare, and education.

This approach helps make essential items more affordable while still collecting VAT on most other goods and services at the standard rate.

You can find more information here.

How to calculate VAT in Ireland on calculator

To calculate VAT on a calculator, follow these steps:

- Determine the VAT Rate: Find the percentage of VAT you need to apply. For instance, it might be 23% in Ireland.

- Identify the Net Price: This is the price before VAT is added. For example, if an item costs €100 without VAT, €100 is your net price.

- Convert the VAT Rate to Decimal Form: Divide the VAT percentage by 100. So, for 23%, divide by 100 to get 0.23.

- Multiply the Net Price by the VAT Decimal: On your calculator, enter the net price (e.g., 100) and multiply it by the VAT decimal (e.g., 0.23). This calculation will show the VAT amount to add. For example, 100 * 0.23 = €23.

- Add the VAT Amount to the Net Price: Now, add the VAT amount to the net price to find the total price including VAT. For example, €100 + €23 = €123.

Following these steps will give you the VAT-inclusive price directly on a calculator.

History of Vat Rates in Ireland

- 1972: Reduced rates: 1%, 5.26%, 11.11%; Standard: 16.37%; Increased: 30.26%

- 1973: Reduced: 1%, 6.75%, 11.11%; Standard: 19.5%; Increased: 36.75%

- 1976: Reduced: 10%; Standard: 20%; Increased: 35%, 40%

- 1979: Reduced: 1%, 10%; Standard: 20%

- 1980: Reduced: 1%, 10%; Standard: 25%

- 1981: Reduced: 1.5%, 15%; Standard: 25%

- 1982: Reduced: 1.8%, 18%; Standard: 30%

- 1983: Reduced: 2.3%, 23%; Standard: 35%

- 1984: Reduced: 2.3%, 23%; Standard: 35%

- 1985: Reduced: 2.2%, 10%; Standard: 23%

- 1986: Reduced: 2.4%, 10%; Standard: 25%

- 1987: Reduced: 1.7%, 10%; Standard: 25%

- 1988: Reduced: 1.4%, 5%, 10%; Standard: 25%

- 1989: Reduced: 2%, 5%, 10%; Standard: 25%

- 1990: Reduced: 2.3%, 10%; Standard: 23%

- 1991: Reduced: 2.3%, 10%, 12.5%; Standard: 21%

- 1992: Reduced: 2.7%, 10%, 12.5%, 16%; Standard: 21%

- 1993: Reduced: 2.5%, 12.5%; Standard: 21%

- 1996: Reduced: 2.8%, 12.5%; Standard: 21%

- 1997: Reduced: 3.3%, 12.5%; Standard: 21%

- 1998: Reduced: 3.6%, 12.5%; Standard: 21%

- 1999: Reduced: 4%, 12.5%; Standard: 21%

- 2000: Reduced: 4.2%, 12.5%; Standard: 21%

- 2001: Reduced: 4.3%, 12.5%; Standard: 20%

- 2002: Reduced: 4.3%, 12.5%; Standard: 21%

- 2003: Reduced: 4.3%, 13.5%; Standard: 21%

- 2004: Reduced: 4.4%, 13.5%; Standard: 21%

- 2005: Reduced: 4.8%, 13.5%; Standard: 21%

- 2008: Reduced: 4.8%, 13.5%; Standard: 21.5%

- 2010: Reduced: 4.8%, 13.5%; Standard: 21%

- 2011: Reduced: 4.8%, 9%, 13.5%; Standard: 21%

- 2012: Reduced: 4.8%, 9%, 13.5%; Standard: 23%

You can learn more about the history of vat in Ireland from here.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- mehrwertsteuer rechner

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

Vat Information for Different Countries

| Country | Standard VAT Rate | Reduced VAT Rate | VAT Authority Website |

|---|---|---|---|

| United Kingdom | 20% | 5% | UK VAT |

| Ireland | 23% | 13.5%, 9%, 4.8% | Revenue Ireland |

| Afghanistan | 10% | – | – |

| Albania | 20% | 6% | – |

| Algeria | 19% | 9% | – |

| Andorra | 4.5% | 9.5% (higher), 1% (reduced) | Andorra VAT |

| Angola | 14% | 7%, 5% | Angola VAT |

| Anguilla | 13% | – | Anguilla GST |

| Argentina | 21% | 27% (higher), 10.5%, 3% | – |

| Australia | 10% | – | ATO GST |

| Austria | 20% | 13%, 10% | Austria VAT |

| Azerbaijan | 18% | – | Azerbaijan VAT |

| Bahamas | 10% | – | Bahamas VAT |

| Bahrain | 10% | – | Bahrain VAT |

| Bangladesh | 15% | 10%, 7.5%, 5%, 4.5%, 2%, 1.5% | Bangladesh VAT |

| Barbados | 17.5% | 22% (higher), 10% | Barbados VAT |

| Belarus | 20% | 26% (higher), 10% | Belarus VAT |

| Belgium | 21% | 12%, 6% | Belgium VAT |

| Benin | 18% | – | Benin VAT |

| Bolivia | 13% | – | Bolivia VAT |

| Bosnia & Herzegovina | 17% | – | Bosnia VAT |

| Botswana | 14% | – | Botswana VAT |

| Brazil | 18% | 12%, 7%, 2%-5%, 1.6%-7.6%, 3% | Brazil VAT |