An Australia GST Calculator is a handy Vat calculating tool designed to help individuals and businesses easily calculate Goods and Services Tax (GST) in Australia. GST is a 10% tax applied to most goods, services, and other items sold or consumed in Australia.

With this calculator, you can quickly work out the GST amount included in a price or add GST to a net price. Whether you’re a business owner preparing invoices or a shopper wanting to know the tax breakdown, the Australia GST Calculator simplifies the process and ensures accurate tax calculations every time.

Australia VAT (GST) Calculator

Results

GST Amount: 0.00 AUD

Total Amount: 0.00 AUD

Table of Contents

What is the VAT Rate in Australia?

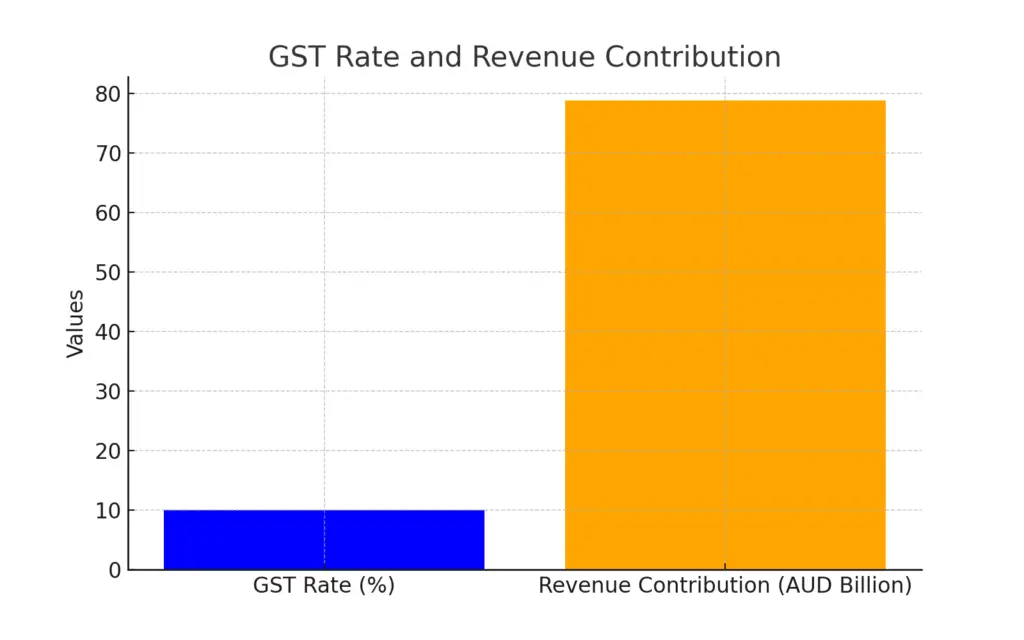

In Australia, the VAT equivalent is called the Goods and Services Tax (GST). The current GST rate is 10%, applicable to most goods and services, including imports.

Businesses registered for GST must include this 10% in their pricing and remit the tax to the Australian Taxation Office (ATO).

For more information, check here.

Key Facts:

- GST was introduced on July 1, 2000, replacing several indirect taxes like wholesale sales taxes.

- Revenue generated from GST: In the 2021-22 fiscal year, GST accounted for approximately AUD 78.9 billion, contributing significantly to Australia’s total tax revenue.

VAT Exceptions in Australia

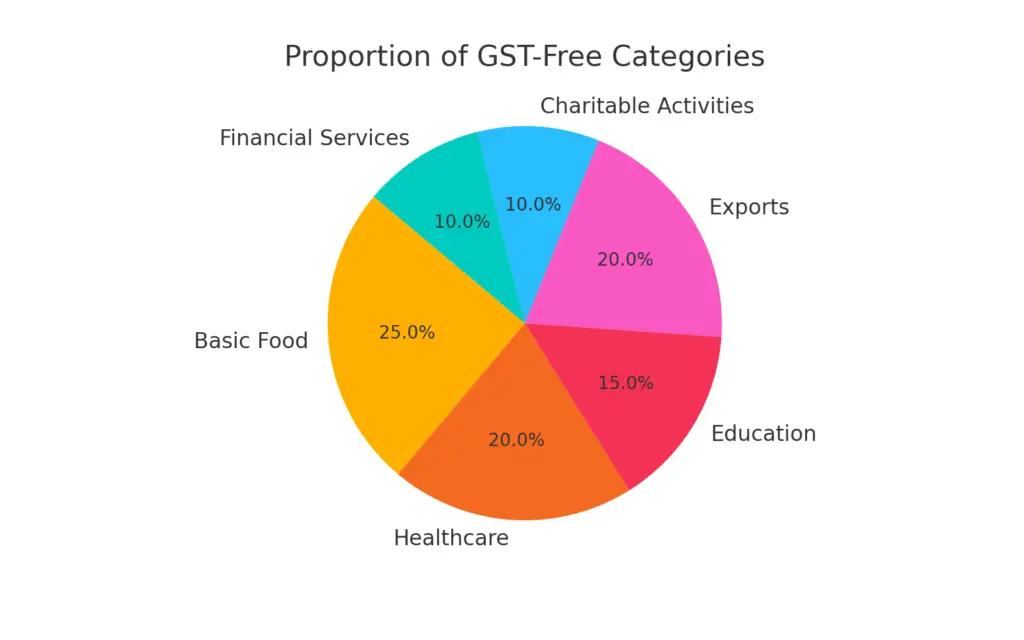

While GST is widely applied, certain goods and services are exempt or subject to reduced vat rates in Australia, offering relief to specific sectors.

GST-Free Goods and Services:

Basic Food Items:

- Fresh fruits and vegetables, bread, meat, milk, and eggs.

- Example: A loaf of bread costing AUD 3 remains GST-free.

Healthcare and Medical Services:

- Services provided by doctors, dentists, and other medical practitioners.

- Prescription medications under the Pharmaceutical Benefits Scheme.

Educational Services:

- School and university fees, course materials, and government-approved vocational training.

Exports:

- Goods exported from Australia are zero-rated (GST applied at 0%) to promote international trade.

Charitable Activities:

- Non-commercial activities by charities, religious organizations, and public benevolent institutions.

Certain Financial Services:

- Interest on loans, bank account fees, and life insurance.

GST-Reduced Categories:

- Some long-term residential accommodation and retirement village supplies are taxed at 5.5% instead of the full 10%.

Value Added Tax History in Australia

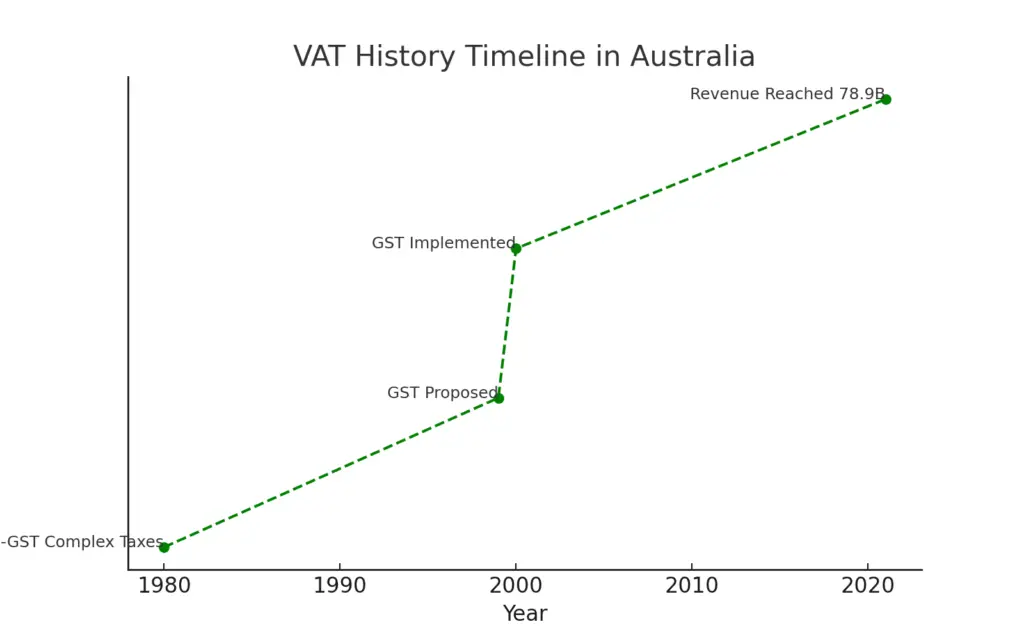

Pre-GST Era:

Before GST, Australia relied on multiple indirect taxes, including:

- Wholesale Sales Tax (WST) ranging between 12% and 32%.

- State and territory taxes, creating a complex and inefficient system.

Introduction of GST:

- Proposed by then Prime Minister John Howard in 1999 as part of a broader tax reform.

- Implemented on July 1, 2000, to simplify the tax system, replacing over 10 existing federal and state taxes.

Impact of GST:

- Simplified tax collection, reducing the administrative burden for businesses.

- Encouraged uniform pricing across states and territories.

- Increased federal revenue, with GST distributed to states and territories to fund essential services.

Statistics Post-GST Implementation:

- Inflation spike: Inflation rose temporarily to 6% in 2000 due to the GST introduction.

- Household spending habits adjusted, with a short-term reduction in consumption as prices rose.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- mehrwertsteuer rechner

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

| Country | Standard VAT Rate | Reduced VAT Rate | VAT Authority Website |

|---|---|---|---|

| United Kingdom | 20% | 5% | UK VAT |

| Ireland | 23% | 13.5%, 9%, 4.8% | Revenue Ireland |

| Afghanistan | 10% | – | – |

| Albania | 20% | 6% | – |

| Algeria | 19% | 9% | – |

| Andorra | 4.5% | 9.5% (higher), 1% (reduced) | Andorra VAT |

| Angola | 14% | 7%, 5% | Angola VAT |

| Anguilla | 13% | – | Anguilla GST |

| Argentina | 21% | 27% (higher), 10.5%, 3% | – |

| Australia | 10% | – | ATO GST |

| Austria | 20% | 13%, 10% | Austria VAT |

| Azerbaijan | 18% | – | Azerbaijan VAT |

| Bahamas | 10% | – | Bahamas VAT |

| Bahrain | 10% | – | Bahrain VAT |

| Bangladesh | 15% | 10%, 7.5%, 5%, 4.5%, 2%, 1.5% | Bangladesh VAT |

| Barbados | 17.5% | 22% (higher), 10% | Barbados VAT |

| Belarus | 20% | 26% (higher), 10% | Belarus VAT |

| Belgium | 21% | 12%, 6% | Belgium VAT |

| Benin | 18% | – | Benin VAT |

| Bolivia | 13% | – | Bolivia VAT |

| Bosnia & Herzegovina | 17% | – | Bosnia VAT |

| Botswana | 14% | – | Botswana VAT |

| Brazil | 18% | 12%, 7%, 2%-5%, 1.6%-7.6%, 3% | Brazil VAT |

Conclusion

Australia’s GST, equivalent to VAT, is crucial to the country’s economy. The 10% rate, combined with specific exemptions, ensures a fair system that balances revenue generation with affordability for citizens.

Its introduction marked a significant turning point in simplifying taxation in Australia, setting a model for transparent and efficient tax collection.