Reverse GST Calculator

What is a Reverse GST Calculator?

A Reverse GST Calculator is a tool designed to determine the original price of a product or service before Goods and Services Tax (GST) was applied. Typically, businesses use it to break down the GST-inclusive price to understand the base amount (exclusive of tax) and the tax amount separately.

Key Features:

- Useful for individuals and businesses who want to know the pre-tax cost.

- Helps in precise financial planning by distinguishing the GST from the total price.

How Does a Reverse GST Calculator Work?

A Reverse GST Calculator works by taking a GST-inclusive price as input and applying a formula to separate the GST portion from the total price. It works with the following steps:

- You input the GST-inclusive amount and select the applicable GST rate (e.g., 5%, 12%, 18%).

- The calculator applies a formula to divide the total by a factor that isolates the GST.

- It then shows the original amount and the GST amount separately.

Formula to Calculate Reverse GST with Example

Formula:

To calculate the pre-GST amount from a GST-inclusive amount, use this formula:

Original Price (before GST) = GST Inclusive Price / (1 + GST Rate)

Where:

- GST Rate is the percentage rate of GST applied (e.g., 5%, 12%, etc.).

Example:

Let’s say the GST-inclusive price is 1,180 and the GST rate is 18%.

- Original Price = 1,180 / (1 + 0.18)

- Original Price = 1,180 / 1.18

- Original Price = 1,000

So:

- GST Amount = 1,180 – 1,000 = 180

- Original Price (before GST) = 1,000

- GST Amount = 180

How to Use a Reverse GST Calculator?

Using a reverse GST calculator is simple and straightforward:

- Enter the Total Price: Input the GST-inclusive price of the item or service.

- Select GST Rate: Choose the GST rate (for example, 5%, 12%, 18%, or 28%).

- Calculate: Click the calculate button, and the calculator will display:

- The base price (original price before GST).

- The amount of GST included in the total.

Most online tools automatically calculate the result based on these inputs, saving time and reducing the risk of errors.

Advantages of Using GST Reverse Calculator

- Time-Efficient: Quickly computes the original cost without manual calculations.

- Accuracy: Reduces human error in separating GST from the total price.

- Cost-Breakdown: Ideal for businesses needing an itemized GST breakdown for accounting purposes.

- Useful for Comparison: Allows comparison between different products and services pre-GST.

Disadvantages of Using GST Reverse Calculator

- Dependency on GST Rates: If the GST rate is incorrect, the result will be inaccurate.

- No Flexibility for Complex Tax Scenarios: It may not accommodate multiple tax layers or compounded tax scenarios.

- Not Suitable for Multi-Rate GST Calculations: For items with multiple GST rates or mixed-tax items, results may not be precise.

- Limited Customization: Most calculators lack features for additional tax breakdowns like cess, making them limited in some cases.

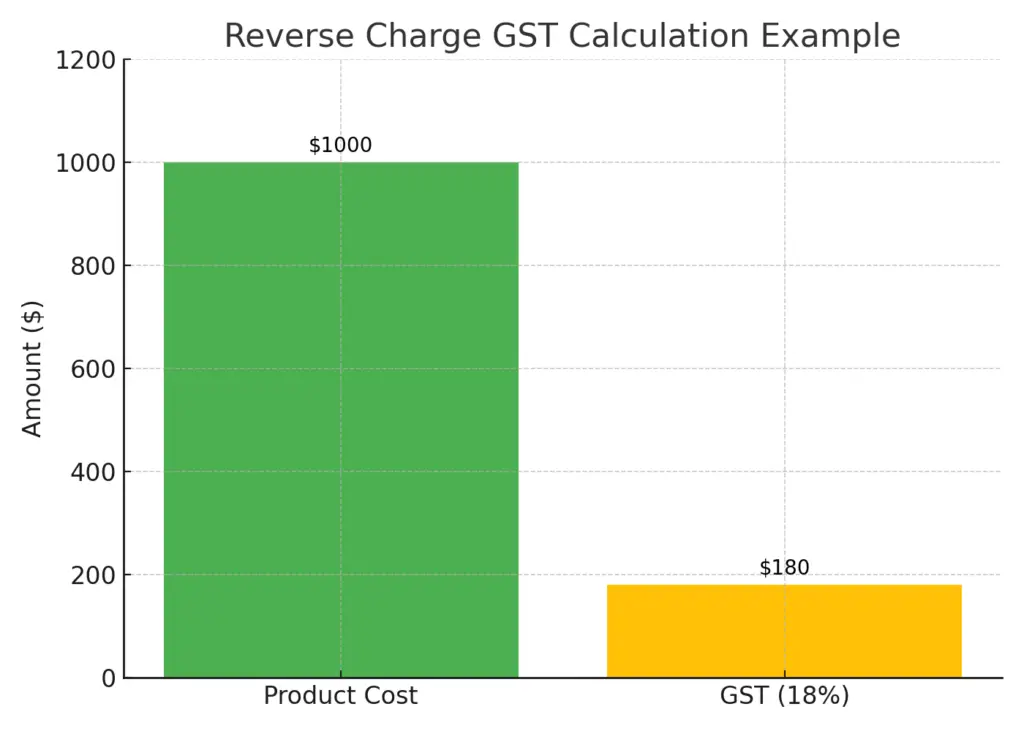

How to calculate reverse charge in GST?

To calculate reverse charge under GST, identify the applicable GST rate for the product or service, then multiply it by the purchase amount. For instance, if the GST rate is 18% on an item costing $1,000, the reverse charge GST is $1,000 x 18% = $180. Reverse charge applies mainly to services like legal consulting, certain imports, and specified goods transactions in India.

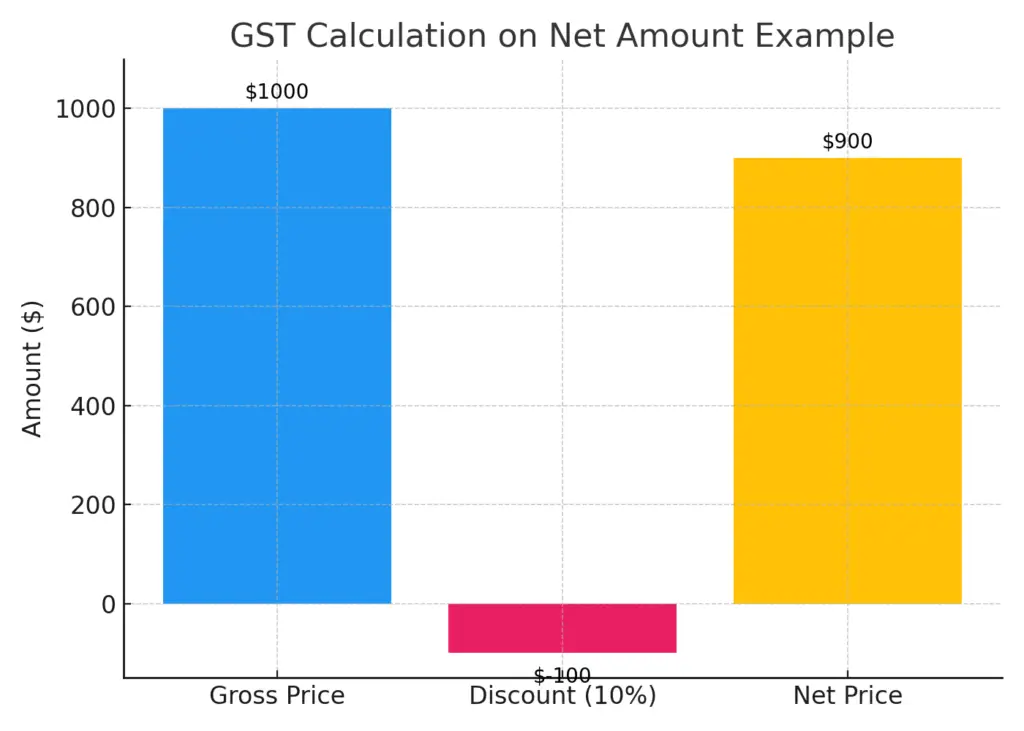

Is GST calculated on gross or net?

GST is calculated on the net amount after discounts. For example, if a product’s gross price is $1,000 and a 10% discount is applied, GST is calculated on the net amount, $1,000 – $100 = $900.

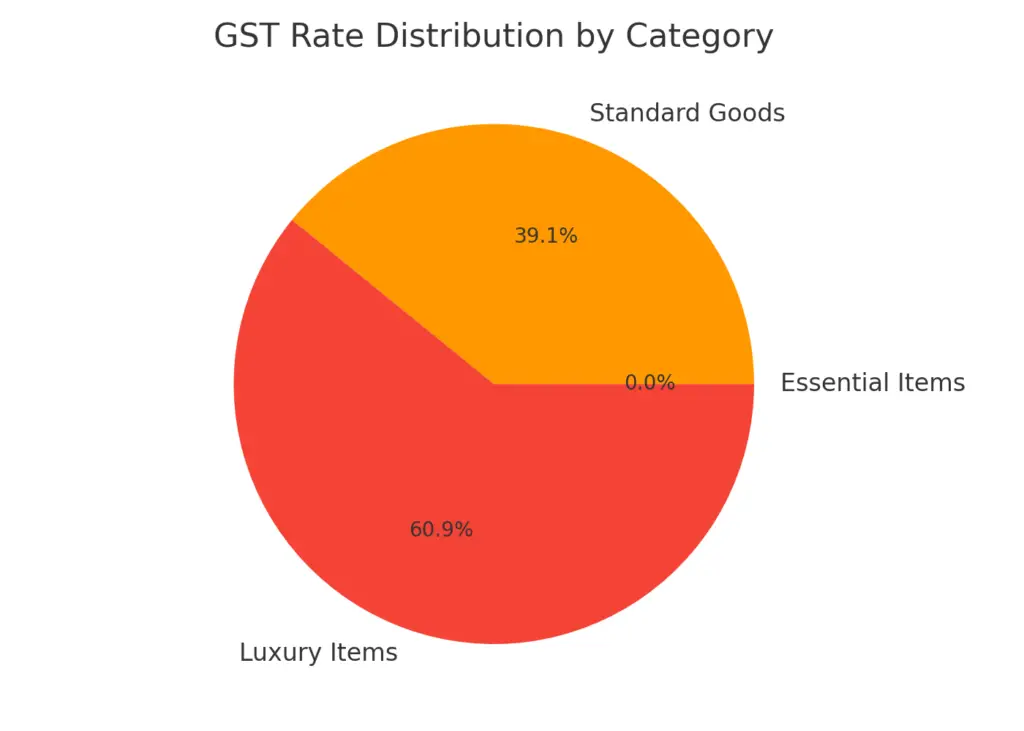

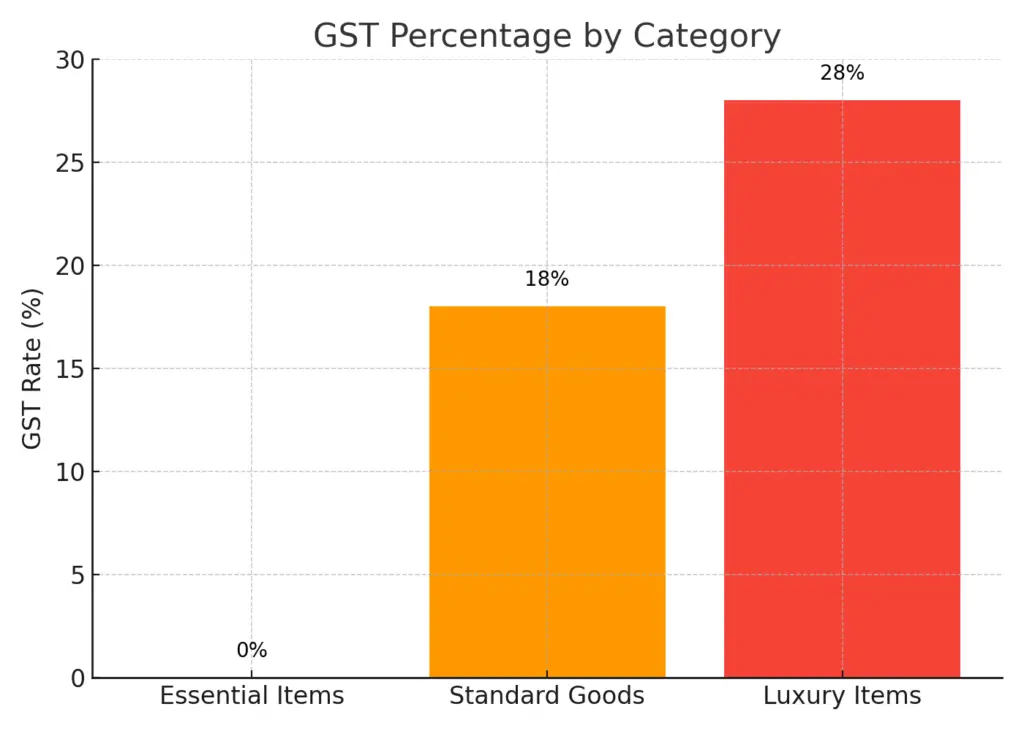

What is the GST percentage?

GST rates vary widely based on the category, typically ranging from 0% to 28% in India. Essential items like basic food often have 0% GST, while standard goods are taxed at 18%, and luxury items may reach 28%.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- mehrwertsteuer rechner

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

| Country | Standard VAT Rate | Reduced VAT Rate | VAT Authority Website |

|---|---|---|---|

| United Kingdom | 20% | 5% | UK VAT |

| Ireland | 23% | 13.5%, 9%, 4.8% | Revenue Ireland |

| Afghanistan | 10% | – | – |

| Albania | 20% | 6% | – |

| Algeria | 19% | 9% | – |

| Andorra | 4.5% | 9.5% (higher), 1% (reduced) | Andorra VAT |

| Angola | 14% | 7%, 5% | Angola VAT |

| Anguilla | 13% | – | Anguilla GST |

| Argentina | 21% | 27% (higher), 10.5%, 3% | – |

| Australia | 10% | – | ATO GST |

| Austria | 20% | 13%, 10% | Austria VAT |

| Azerbaijan | 18% | – | Azerbaijan VAT |

| Bahamas | 10% | – | Bahamas VAT |

| Bahrain | 10% | – | Bahrain VAT |

| Bangladesh | 15% | 10%, 7.5%, 5%, 4.5%, 2%, 1.5% | Bangladesh VAT |

| Barbados | 17.5% | 22% (higher), 10% | Barbados VAT |

| Belarus | 20% | 26% (higher), 10% | Belarus VAT |

| Belgium | 21% | 12%, 6% | Belgium VAT |

| Benin | 18% | – | Benin VAT |

| Bolivia | 13% | – | Bolivia VAT |

| Bosnia & Herzegovina | 17% | – | Bosnia VAT |

| Botswana | 14% | – | Botswana VAT |

| Brazil | 18% | 12%, 7%, 2%-5%, 1.6%-7.6%, 3% | Brazil VAT |