What is the VAT Rate in the UK?

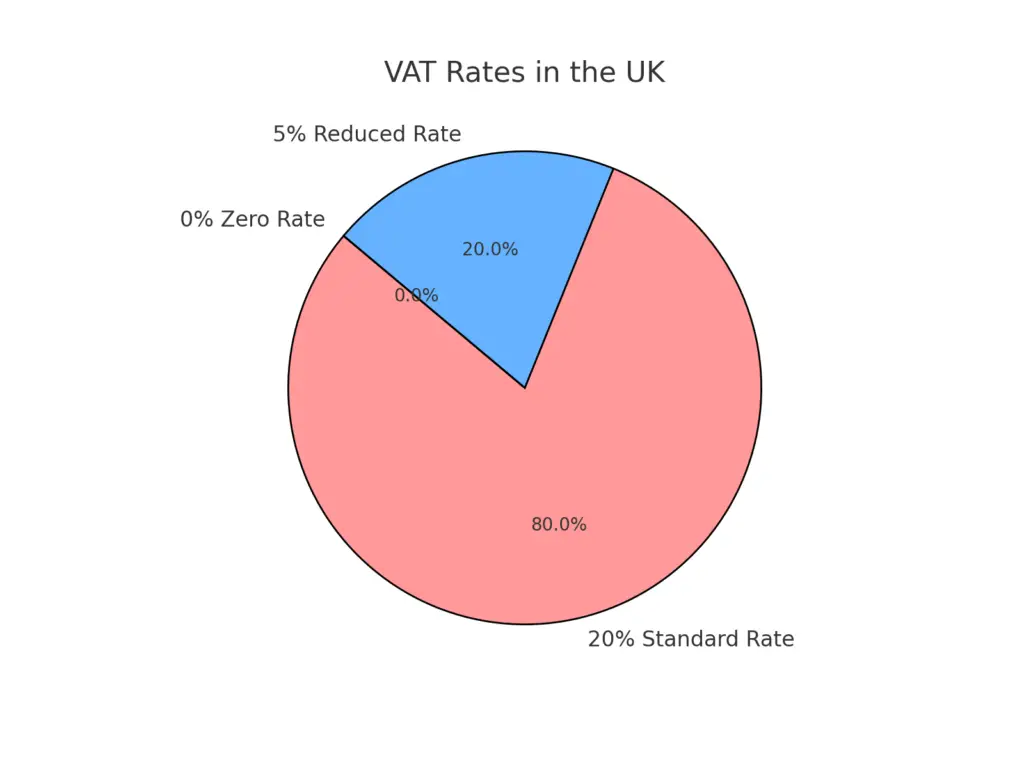

The United Kingdom’s standard VAT rate is currently 20%, applicable to most goods and services, such as electronics, fashion, and professional services. In addition to this, there are reduced rates:

- 5% Reduced Rate: This rate is applied to specific goods and services like children’s car seats, home energy (gas and electricity), residential heating, and energy-saving materials. This reduced rate aims to support affordability in essential services and goods.

- 0% Zero Rate: Certain essential items are zero-rated, meaning VAT is technically charged but at a rate of 0%. Zero-rated items include most food and drink for human consumption, books, newspapers, children’s clothing, and medical supplies. While businesses still record VAT on these sales, consumers pay no additional tax on the items.

These rate categories help the government generate revenue from most products while making basic goods and services more affordable for the public. The VAT revenue contributed a significant part of the UK government’s income, totaling approximately £147 billion in 2022, representing about 20% of total tax receipts.

For more details about Uk vat rates, check here and here.

VAT Exceptions in the UK

Certain goods and services in the UK are exempt from VAT entirely, meaning they fall outside the scope of VAT and businesses providing these services cannot reclaim VAT on related costs. Key VAT exemptions include:

- Financial Services: Banking and insurance products, loans, and credit services are VAT-exempt.

- Education: School and university fees, as well as training courses provided by accredited institutions, are exempt to promote accessible education.

- Healthcare Services: Most healthcare services provided by medical professionals are VAT-exempt, ensuring that essential healthcare remains accessible and affordable.

These exemptions support critical sectors and prevent VAT from being an added cost in areas that impact everyday life and welfare, such as healthcare and education.

Value Added Tax History in the UK

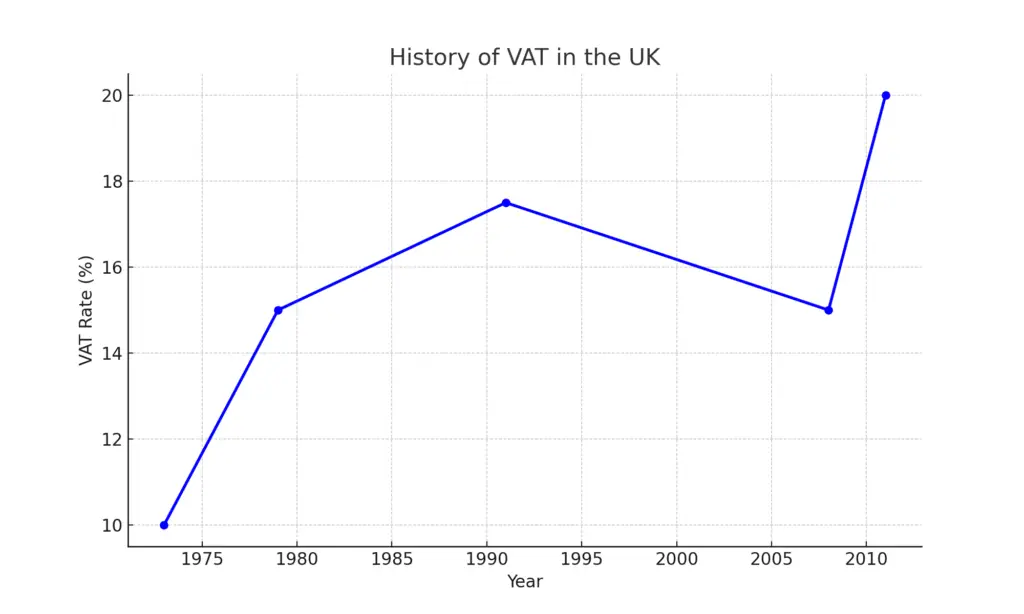

VAT in the UK was introduced in 1973, replacing the Purchase Tax as part of the conditions for joining the European Economic Community (EEC). Initially, the VAT rate was set at 10%, but the rates and structure have changed several times over the years:

- 1979: The standard rate was raised to 15% under the Conservative government to support fiscal policy shifts.

- 1991: VAT increased from 15% to 17.5%, following the government’s need for additional revenue.

- 2008–2011: In response to the financial crisis, the VAT rate was temporarily reduced to 15% to boost consumer spending, then raised to 17.5% before being set at 20% in 2011 to manage government debt and economic recovery.

The VAT rate has remained at 20% since 2011, making it one of the major sources of revenue for the UK government. Today, VAT is an integral part of the UK’s tax system, contributing significantly to the government’s annual revenue and playing a role in fiscal policy adjustments.

For more information about the history of Vat in UK, check here and here.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- mehrwertsteuer rechner

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

How to calculate VAT in the UK?

To calculate VAT in the UK, follow these steps:

- Identify the VAT rate: Most goods and services have a VAT rate of 20%. However, reduced rates of 5% or 0% apply to specific categories.

- Calculate VAT amount:

- If the price is exclusive of VAT, multiply the price by the VAT rate (e.g., 20%) and then add it to the original price. For instance, if the item costs £100 and VAT is 20%, the VAT is £100 x 0.20 = £20, making the total £120.

- If the price is inclusive of VAT, divide the price by 1 + VAT rate (e.g., 1.20 for 20%) to find the pre-VAT price, then multiply to find VAT. For example, if a product costs £120 inclusive of VAT at 20%, the VAT amount is £120 / 1.20 = £100 (pre-VAT), and £20 (VAT).

Is 20% VAT in the UK?

Yes, the standard VAT rate in the UK is 20%. This rate applies to most goods and services, including electronics, fashion, and professional services.

How do I figure out my VAT rate?

Your VAT rate depends on the type of goods or services you provide:

- 20% Standard Rate: Applies to most products and services.

- 5% Reduced Rate: Applies to specific items like children’s car seats, home energy (gas and electricity), and energy-saving materials.

- 0% Zero Rate: Applies to essential items such as most food for human consumption, books, newspapers, children’s clothing, and medical supplies.

- Exemptions: Some services like financial services, healthcare, and education are VAT-exempt, meaning no VAT is charged.

Is the VAT rate 12.5% in the UK?

No, 12.5% is not a standard VAT rate in the UK. The primary VAT rates are 20% (standard), 5% (reduced), and 0% (zero-rated). However, during the COVID-19 pandemic, a temporary 12.5% VAT rate applied to certain hospitality services, but it has since returned to the standard rates.

How is VAT charged in the UK?

VAT in the UK is charged at the point of sale on taxable goods and services. Businesses registered for VAT add the applicable rate (20%, 5%, or 0%) to the price of their goods or services. The VAT amount is then collected by the business and paid to HM Revenue and Customs (HMRC). Consumers pay VAT included in the final price, while businesses can typically reclaim VAT on purchases made for business purposes.

Who pays VAT in the UK?

In the UK, VAT is paid by the end consumer. Businesses collect VAT on sales and submit it to HMRC, but the cost is ultimately borne by consumers when they purchase goods and services. Businesses can reclaim VAT on allowable expenses, effectively passing the cost to the final consumer.

What is VAT-free in the UK?

Certain items are VAT-free in the UK, typically zero-rated, meaning VAT is charged at 0%. These items include:

- Most food and drink for human consumption (excluding alcohol and dining out).

- Printed books, newspapers, and children’s clothing.

- Medical supplies and equipment.

- Exempt items such as financial services, healthcare, and education are also effectively VAT-free, as no VAT is charged.

These categories aim to keep essential goods and services affordable by removing the added VAT cost.

| Country | Standard VAT Rate | Reduced VAT Rate | VAT Authority Website |

|---|---|---|---|

| United Kingdom | 20% | 5% | UK VAT |

| Ireland | 23% | 13.5%, 9%, 4.8% | Revenue Ireland |

| Afghanistan | 10% | – | – |

| Albania | 20% | 6% | – |

| Algeria | 19% | 9% | – |

| Andorra | 4.5% | 9.5% (higher), 1% (reduced) | Andorra VAT |

| Angola | 14% | 7%, 5% | Angola VAT |

| Anguilla | 13% | – | Anguilla GST |

| Argentina | 21% | 27% (higher), 10.5%, 3% | – |

| Australia | 10% | – | ATO GST |

| Austria | 20% | 13%, 10% | Austria VAT |

| Azerbaijan | 18% | – | Azerbaijan VAT |

| Bahamas | 10% | – | Bahamas VAT |

| Bahrain | 10% | – | Bahrain VAT |

| Bangladesh | 15% | 10%, 7.5%, 5%, 4.5%, 2%, 1.5% | Bangladesh VAT |

| Barbados | 17.5% | 22% (higher), 10% | Barbados VAT |

| Belarus | 20% | 26% (higher), 10% | Belarus VAT |

| Belgium | 21% | 12%, 6% | Belgium VAT |

| Benin | 18% | – | Benin VAT |

| Bolivia | 13% | – | Bolivia VAT |

| Bosnia & Herzegovina | 17% | – | Bosnia VAT |

| Botswana | 14% | – | Botswana VAT |

| Brazil | 18% | 12%, 7%, 2%-5%, 1.6%-7.6%, 3% | Brazil VAT |