The Philippines VAT Calculator is a simple tool designed to help you calculate Value-Added Tax (VAT) quickly and accurately. Whether you’re a business owner, accountant, or shopper, this calculator allows you to include or exclude VAT from any amount.

With preset VAT rates for standard and special transactions in the Philippines, plus an option to add a custom rate, you can tailor it to your specific needs.

Philippines VAT Calculator

Calculate VAT for the Philippines. Select a VAT rate or add your custom rate, then choose whether to include or exclude VAT in your calculation.

Calculation Result

Enter the details above to see the result.

Disclaimer:

This Philippines VAT Calculator is for informational purposes only. While we strive for accuracy, the results provided may not reflect the exact VAT amounts due to regional variations or specific legal requirements. Always consult with a tax professional or visit the Philippines Bureau of Internal Revenue (BIR) here for precise calculations and compliance with local tax laws.

Table of Contents

How to Use the Philippines VAT Calculator

Follow these steps to calculate VAT effortlessly:

Enter the Amount

- Input the total amount you want to calculate VAT for in the provided field.

Select the VAT Rate

- Use the dropdown menu to choose the applicable VAT rate.

- Available options include standard rates and rates for specific purposes.

- If your required rate isn’t listed, select the “Custom Rate” option and input your desired VAT rate.

Choose VAT Calculation Type

- Click “Include VAT” to calculate the amount inclusive of VAT.

- Click “Exclude VAT” to determine the amount exclusive of VAT.

View Your Results

- The calculator will display the VAT amount and the total or base amount, depending on your selection.

Repeat as Needed

- Adjust the input fields or rate and repeat the steps for multiple calculations.

This calculator simplifies VAT computations for businesses and individuals, ensuring quick and reliable results.

Tools:

- Ireland VAT Calculator

- Madhya Pradesh VAT Rate Calculator

- Spain VAT Refund Calculator

- Nigeria Customs Duty Calculator

- Calcular IVA

- South Korea VAT Refund Calculator

- Pakistan Customs Duty Calculator

- Indian Customs Duty Calculator

- US Customs Duty Calculator

- Brazil Sales Tax Calculator

- China VAT Calculator

- Denmark VAT Refund Calculator

- Greece VAT Calculator

- GST Calculator

- GST HST Calculator

- Import Duty Calculator

- India GST Calculator

- Morocco Import Duty Calculator

- New Zealand GST Calculator

- Reverse GST Calculator

- U.S. Sales Tax Calculator

- UK VAT Tax Calculator

- Philippines VAT Calculator

- Australia VAT (GST) Calculator

- mehrwertsteuer rechner

- spain vat calculator

- Italy vat calculator

- Germany VAT Calculator

- Belgian Vat Calculator

- Germany Vat Calculator

- France Vat Refund Calculator

- France vat calculator

- Singapore GST Refund Calculator

- Japan Tax Refund Calculator

FAQs About the Philippines VAT Calculator

What is the VAT rate in the Philippines?

- The standard VAT rate in the Philippines is 12%, applied to most goods and services. Certain transactions, like exports, are VAT-exempt or zero-rated as per the Tax Reform for Acceleration and Inclusion (TRAIN) law.

How does the Philippines VAT Calculator work?

- The calculator computes VAT amounts based on the selected rate. For example, if you input an amount of PHP 10,000 and select the 12% VAT rate, the VAT-inclusive amount would be PHP 11,200, while the VAT-exclusive amount would be PHP 8,928.

Can I add custom VAT rates to the calculator?

- Yes! If your transaction involves a unique VAT rate (e.g., for special zones or exemptions), the calculator allows you to input a custom rate for tailored computations.

What is the purpose of the “Include VAT” and “Exclude VAT” buttons?

- These options let users calculate the VAT-inclusive price (e.g., adding 12% VAT to PHP 1,000 = PHP 1,120) or the VAT-exclusive price (e.g., PHP 1,120 – 12% VAT = PHP 1,000).

Are VAT-exempt goods included in the calculator?

- VAT-exempt goods like fresh food, educational materials, and some agricultural products are not calculated for VAT. However, you can input the amount and select “0%” VAT for reference.

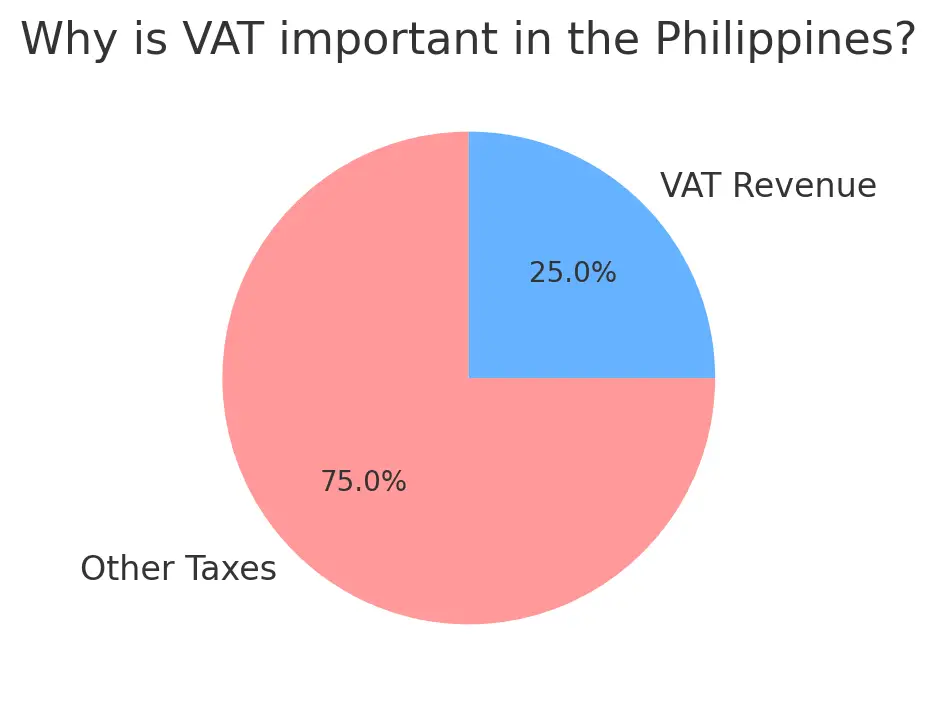

What is the revenue impact of VAT in the Philippines?

- VAT contributes significantly to government revenue, accounting for around 20-25% of total tax collections, according to the Bureau of Internal Revenue (BIR).

Who needs to register for VAT in the Philippines?

- Businesses with annual gross sales exceeding PHP 3 million are required to register for VAT under the TRAIN law. Non-VAT registered businesses should apply a percentage tax instead.

How accurate is this VAT calculator?

- This calculator uses the latest VAT rates and simplifies computations for everyday transactions. However, it does not cover complex scenarios like tax adjustments, so consulting a tax expert is advisable.

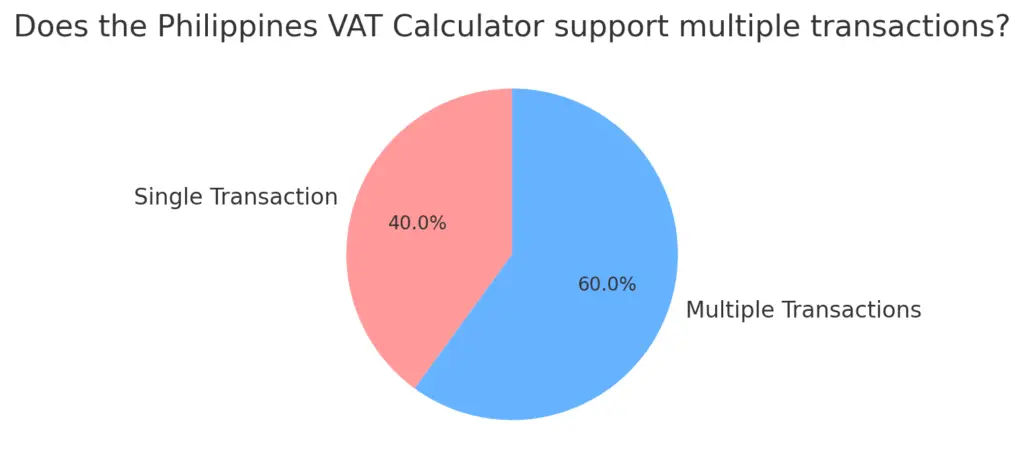

Does the Philippines VAT Calculator support multiple transactions?

- Yes, you can calculate VAT for multiple transactions by re-entering amounts and rates. This makes it useful for businesses managing varied VAT rates.

Why is VAT important in the Philippines?

- VAT ensures equitable tax collection across sectors and funds critical government programs. In 2023, VAT generated approximately PHP 400 billion, highlighting its role in economic development.

These FAQs are designed to provide users with actionable insights while boosting the visibility of your Philippines VAT Calculator online.